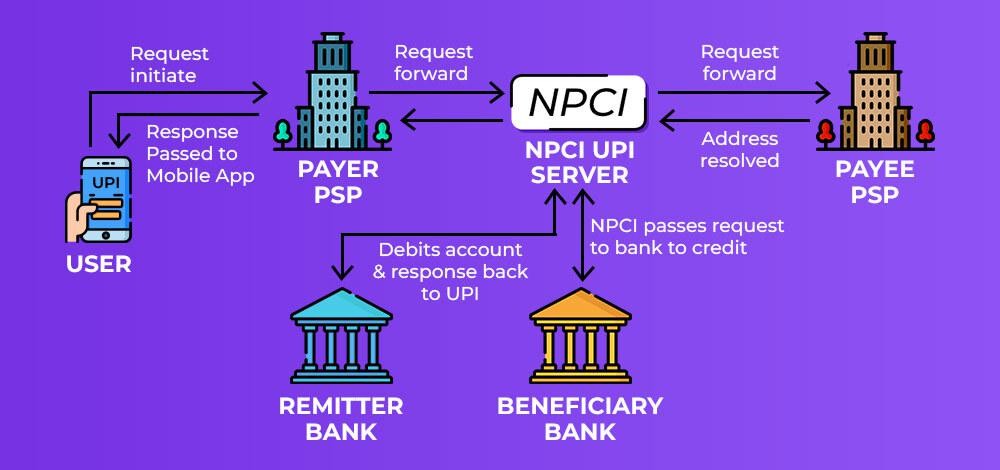

India’s real-time payment revolution — Unified Payments Interface (UPI) — has grown exponentially over the past few years, now processing over 13 billion transactions monthly. As the digital ecosystem matures, the National Payments Corporation of India (NPCI), under guidance from the Reserve Bank of India (RBI), has introduced a series of UPI new rules and technical changes starting August 1, 2025.

The goal: improve system efficiency, reduce server load, and ensure scalability as more users and businesses adopt UPI new rules in India. While some changes are behind-the-scenes, others could directly affect users — especially high-frequency payers, merchants, and wallet users who rely on credit cards to load funds.

Here’s a detailed breakdown of what’s changing, why it matters, and how you can keep your UPI usage cost-effective.

UPI New Rules in India: Free for Users — But Aggregators Must Pay

Amid rising speculation earlier this year, there was widespread concern that UPI payments might no longer be free for users. Those fears were quickly dismissed by NPCI and the Ministry of Finance. The new rules clearly state that UPI remains free for both users and small merchants.

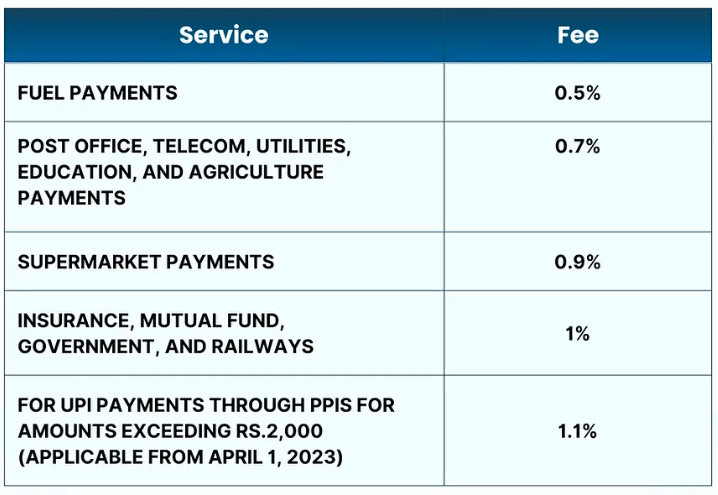

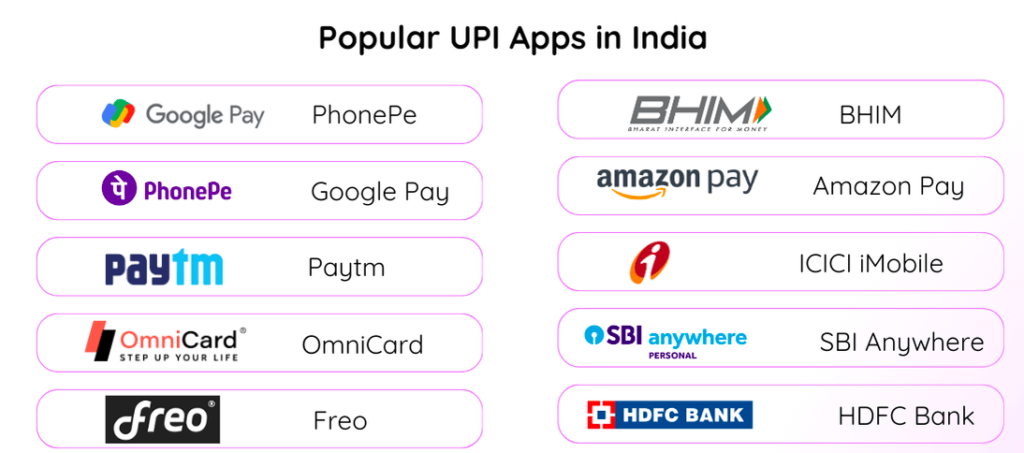

However, the NPCI has introduced charges for payment aggregators and third-party app providers (like Google Pay, PhonePe, Paytm) to cover backend infrastructure costs. These charges will not be passed on to end-users. Banks will levy fees on apps that process UPI transactions at scale, especially those exceeding set transaction volume thresholds. The policy incentivizes optimal backend usage and discourages excessive, unnecessary API calls.

In parallel, there’s also an ongoing debate within the Finance Ministry on whether large e-commerce and enterprise-scale merchants should pay a 0.2–0.3% MDR (Merchant Discount Rate) for UPI payments. As of now, no such MDR has been implemented, and UPI remains zero-MDR for all merchants.

Read more: iQOO Z10 5G Review, Specs and Features

What’s Changing: Detailed New UPI Rules Effective August 1, 2025

The UPI ecosystem has long allowed app developers significant flexibility in accessing user data and triggering transaction flows. However, excessive backend requests (like frequent balance checks and account info retrievals) have created pressure on UPI servers. To address this, NPCI has announced strict API rate limits and operational rules for UPI participants.

Comparison Table: New UPI Rules Before and After August 1, 2025

| Feature | Old Rules | New Rules (From August 1, 2025) |

|---|---|---|

| Balance Checks per UPI App | Unlimited | Capped at 50 per day |

| View Linked Bank Accounts | Unlimited | Capped at 25 views per day |

| Autopay (e-mandate execution) | Anytime | Allowed only before 10 AM, 1–5 PM, after 9:30 PM |

| Transaction Status Checks | Unlimited | Max 3 checks per txn with 90-second gaps |

| API Response Time (Bank/App) | Variable | Must respond within 10–15 seconds |

| Beneficiary Name Display | Optional | Now mandatory before payment completion |

| Refund / Chargeback Requests | No specific limits | Max 10/month, 5 to same entity |

| UPI ID Deactivation | Not defined | IDs linked to inactive mobile no. auto-deleted after 12 months |

| Security Audits | Irregular | Annual audit mandatory for all providers |

| New KYC Verification | Basic phone-SMS based | Stricter authentication on new UPI linking |

These changes are designed to optimize performance and prevent abuse, particularly by third-party apps that might flood NPCI systems with redundant queries.

Credit Card to Wallet Top-Ups Still Attract Charges

Another area that continues to see charges — and confusion — is the use of credit cards to load money into wallets (e.g., Paytm Wallet, PhonePe Wallet, Amazon Pay Balance, MobiKwik, etc.). While UPI remains free, wallet providers levy their own charges when users try to load funds via a credit card.

Typical Charges (As of August 2025)

- Paytm Wallet: 2%–4% of the load amount + GST

- MobiKwik: ~2% standard + GST

- PhonePe Wallet: 1.5%–3% depending on the credit card and bank

- Amazon Pay: 2.36% or more depending on card type

- ICICI Pockets & HDFC PayZapp: 1.5%–2.5% + GST

- Freecharge: Usually 2%

These fees are wallet-specific and have nothing to do with UPI directly. Still, users often get confused when they see deductions during wallet top-ups via credit cards and mistakenly associate it with UPI changes.

The takeaway? Using a credit card to directly fund wallets is still a charged service, and the August 1 UPI updates do not impact these fee structures.

Why Are These UPI New rules Happening Now?

UPI has become a backbone of India’s digital payments infrastructure. With rising volumes — expected to cross 20 billion transactions per month by 2026 — the RBI and NPCI are proactively preparing for scale.

Frequent UPI server outages in 2024 raised alarms over resilience and redundancy. Large players like PhonePe and Paytm were criticized for excessive API calls, like repeated balance refreshes every few seconds. These behaviors caused backend slowdowns for all users.

The new rules aim to:

- Limit non-essential system usage

- Force apps to use cache efficiently

- Ensure faster response times

- Improve user experience during peak hours

- Prevent denial-of-service-type overloads

In short, the rules are not punitive for users — they are architectural safeguards to protect system stability.

Smart Tips to Avoid Charges and Use UPI Efficiently After August 1

With so many updates in effect, here are practical ways users can maximize their UPI usage while avoiding unwanted charges or delays:

Avoid Credit Card Top-Ups to Wallets

If you want to avoid fees, do not use your credit card to top up wallets. Instead, transfer directly via UPI using your bank account or use UPI Lite for low-value transactions.

Use UPI Lite for Small Payments

UPI Lite, the wallet-like system for small, PIN-less payments (under ₹500 per transaction), is expanding. It is fast, doesn’t hit main bank APIs, and ensures smooth transactions without failures. It’s ideal for chai stalls, groceries, or snack vendors.

Combine Multiple Small Transactions into One

If you are making frequent small payments in a day — for recharges, bills, or subscriptions — consider bundling them. Fewer large transactions reduce API hits and minimize the chance of hitting usage caps.

Limit Balance/Status Checks

Avoid refreshing your balance or status screen repeatedly. You only get 50 balance inquiries and 3 status checks per transaction. After that, the system may restrict further queries, and you’ll have to wait.

Space Out Status Checks

If a transaction is stuck, wait at least 90 seconds before checking again. Status checks made too soon may not return new results and will count against your 3-check quota.

Use Your Primary UPI App

Stick to one or two UPI apps rather than splitting across five or six. The new limits (e.g., 25 linked account views or 50 balance checks) apply per app. Using fewer apps reduces your risk of hitting per-app limits.

Schedule AutoPay Transactions During Non-Peak Hours

Recurring mandates (like Netflix, insurance premiums, electricity) now only process during off-peak windows. Set your mandate execution time before 10 AM or after 9:30 PM to avoid delays.

Avoid Repeated Refunds and Chargebacks

NPCI now limits you to 10 refund requests per month, and only 5 per merchant or individual. Abuse this limit, and future refund requests may be rejected.

Update Your UPI ID and Mobile Number Regularly

UPI IDs linked to inactive mobile numbers older than 12 months will be auto-deactivated. Make sure your mobile number is current with your bank to avoid disruption.

Watch for Future MDR Changes on High-Value Transactions

Though not yet implemented, the government may soon apply MDR for high-value commercial UPI payments. If introduced, you may want to switch to NEFT/IMPS for large merchant transactions.

Are There Any Changes for Merchants?

As of August 1, merchants — big or small — continue to enjoy zero MDR. No changes have been made to fees levied on shopkeepers, vendors, or businesses accepting UPI.

However, **payment aggregators and UPI apps** will now bear infrastructure costs if their daily UPI volumes cross defined thresholds. This has sparked concerns that some aggregators may eventually introduce premium services or charge merchants indirectly, though no such trends have materialized so far.

Small businesses using QR codes, POS-linked UPI, or dynamic QR bills remain unaffected.

Security: Audits and Verification

Another important dimension to the new rules is cybersecurity.

All UPI banks and app providers are now required to undergo annual audits from a CERT-IN-empanelled cybersecurity firm. This ensures that vulnerabilities are caught early, and that apps do not leak sensitive financial data.

Additionally, the KYC process for new UPI user onboarding has been tightened. Users linking bank accounts with a new app for the first time must go through enhanced verification, which may involve biometric e-KYC, PAN linking, or Aadhaar-based validation.

This step aims to prevent fraudulent accounts, mule activity, and phishing attempts that spiked in 2023 and 2024.

A Smarter, Safer UPI New rules for a Growing Economy

UPI has become more than just a payments interface — it’s now the default mode of transaction for most Indians. As it powers credit lines, subscription mandates, e-commerce, investments, and even salary disbursements, its evolution is inevitable.

The changes rolling out from August 1, 2025, are not designed to restrict user freedom but to optimize platform performance for all. With minor habit adjustments — like limiting status checks or avoiding credit card wallet loads — users can continue to enjoy seamless, secure, and free digital payments across India.

In an economy increasingly driven by cashless confidence, UPI remains the crown jewel of India’s fintech story — and with smarter rules, it’s poised to handle the next billion transactions with ease.